nanny tax calculator texas

Taxes Paid Filed - 100 Guarantee. Nannies can expect to pay 10-30 percent of their gross wages including.

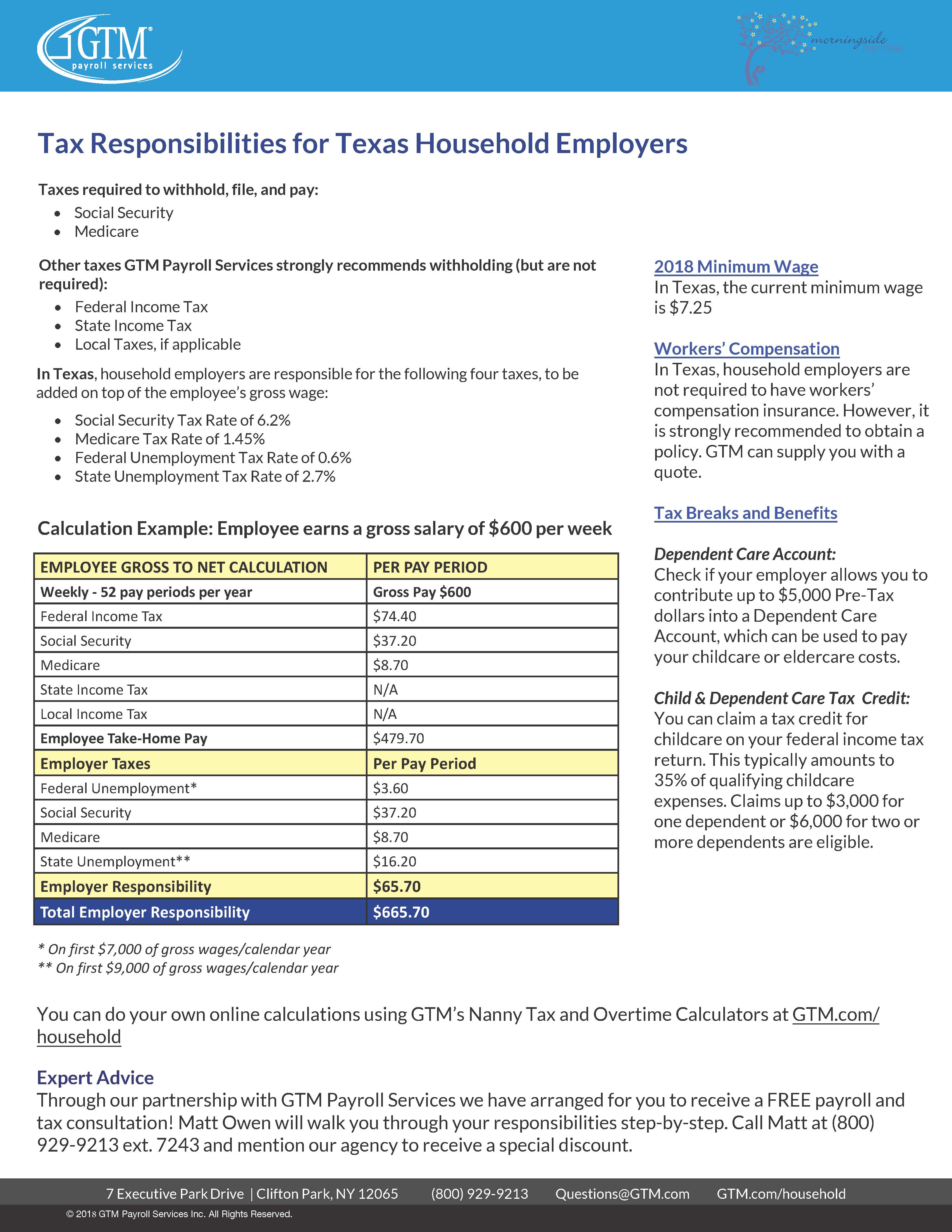

2018 Nanny Tax Responsibilities

Calculating nanny taxes.

. Employers that do not. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. The average total salary of Nannies in Texas is 27500year based on 586 tax returns from TurboTax customers who reported their occupation as nannies in Texas.

GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Use our nanny tax calculator to help determine your nanny tax. Please tick this box if you would like to receive advice and relevant news on employing and working with nannies and.

As mentioned nanny taxes fall into two main buckets for employers. You can also print a pay stub once the pay has been. Key in basic data like the hourly wage and get an estimate of how much you will have to pay per month and per year.

Taxes Paid Filed - 100 Guarantee. Enter your employees information and click on the Calculate button at the. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex.

As for Social Security and Medicare tax payment 765 will be shouldered by. Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes.

Nanny Tax Hourly Calculator. Federal and state income taxes not required. On a quarterly basis.

Please call us at 1-888-273-3356 or consult your tax. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get your FREE step-by-step guide to managing Nanny Tax Payroll.

The Nanny Tax Company has moved. A household employer is responsible to remit. Our new address is 110R South.

Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax.

Form C-20 or C-20F for annual filing. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

It is intended to provide general payroll estimates only. TWC Rules 815107 and 815109 require all employers to report Unemployment Insurance UI wages and to pay their quarterly UI taxes electronically. Were here to help.

This calculator is intended to provide general payroll estimates only. Payroll taxes in Texas are. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not.

Put values into the required input fields marked with an and optionally. Enter your info to see your take home pay.

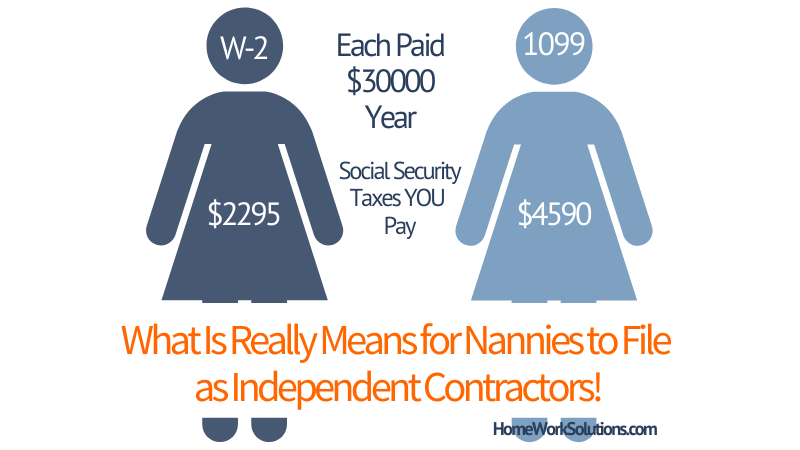

How Does A Nanny File Taxes As An Independent Contractor

Nanny Tax Calculators Nanny Payroll Calculators The Nanny Tax Company

How To Pay Your Nanny S Taxes Yourself Diy For Paying Household Employees

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

![]()

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

Breaking The Barriers To Legal Pay Nanny Magazine

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Tax Guide For Paying Household Employees

Caregivers How To Handle Unethical Requests From Your Boss Caregiver Nanny Jobs Childcare Jobs

How To Professionally Terminate A Nanny Or Senior Caregiver Care Com Homepay

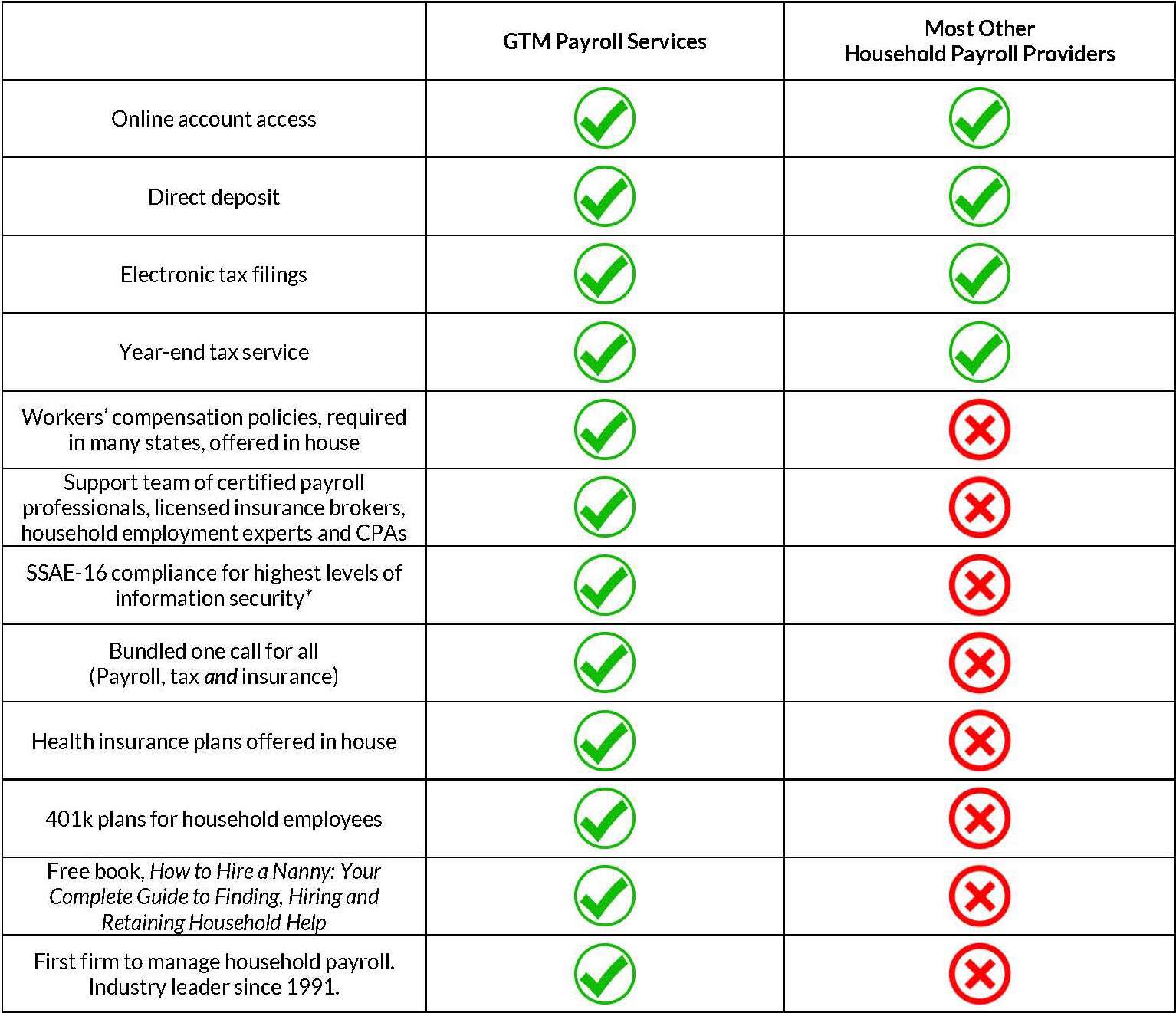

Nanny Payroll Service Comparison Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Payroll Services For Households Adp

Common Nanny Tax Questions Poppins Payroll Poppins Payroll

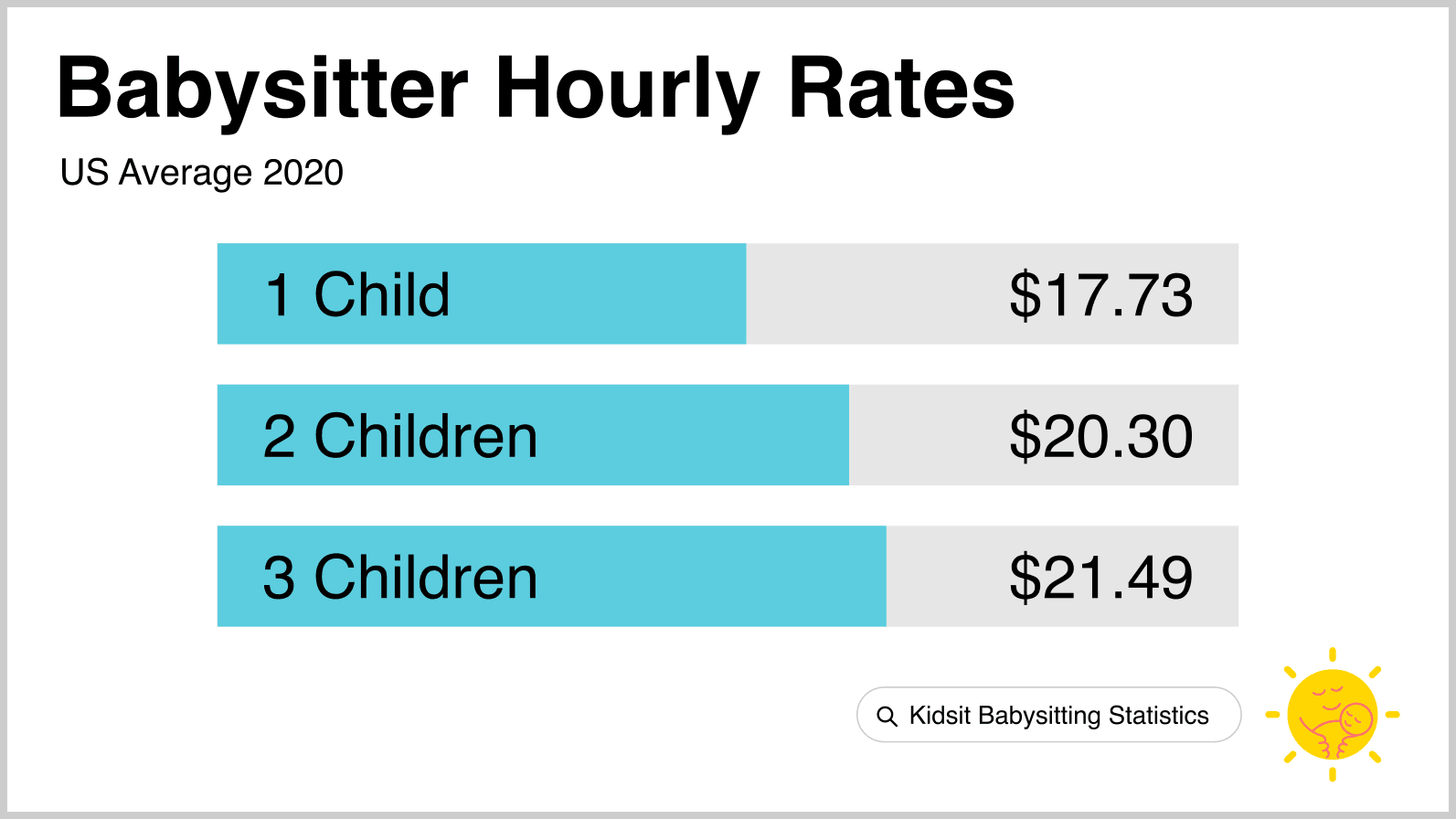

Babysitting Pay Rates How Much Should You Charge

Nanny Taxes And Payroll Services Poppins Payroll Poppins Payroll