bear trap stock term

Showed that the SP 500 Index bottomed only after earnings per share forecasts had fallen either to or below the level they were at. This makes a lot of people sell their stocks but then the market turns around and goes back up really quickly.

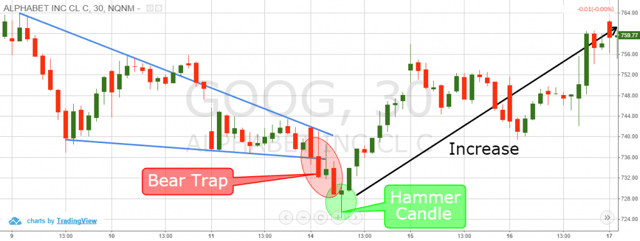

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

When the price of the security rises the short seller must buy shares to maintain his margin rate.

. Bearish investors who have shorted or bet against that stock may experience losses. All of this action suggests markets may have hit some form of short-term bottom. In general a bear trap is a technical trading pattern.

These are unexpected movements that can incur great losses to traders if they are not careful. It is the predicament facing short-sellers when a bear market reverses. Some institutions push stock prices lower to create more demand.

An accumulation of shares being sold short by bears trying to drive down the price of a stock. A bear trap is when the stock market suddenly stops going up and starts going down. A bear market is a condition in which securities prices fall and widespread pessimism causes the stock markets downward spiral to be self-sustaining.

Investors and traders take short positions thinking that the rally is over. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Investors anticipate losses as.

A bear trap occurs when a stock or another security that is losing value suddenly reverses course and begins to gain value instead. The service is tailored for asset managers hedge funds financial advisors traders and more. An A to Z Guide to Investment Terms for Todays Investor by David L.

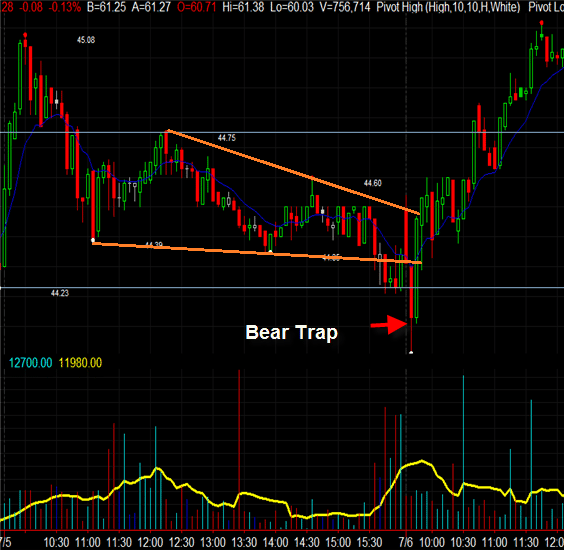

A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside. Tesla stock in 2020 with short squeezes. 9 1931 stocks gained 306.

A Bear Trap is a device that is used to capture bears. Outliers include the rally that occurred during the bear market of April 1930 that ran through July 1932. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price.

People who sell their stocks end up losing money. Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

This drives the prices back up again. With many investors afraid that the recent strength in. Bear Trap is a term that indicates trading situations when a certain stock s price is going downward for a long period of time but suddenly reflects a misleading upward sloping that results in a trap for the short seller.

The net income run rate is now 84 billion which is. However instead of continuing to fall the stock reverses and moves past its prior high. This type of false indication is basically a trap where traders tend to get fooled and fall for it.

Bull traps and bear traps are forms of the whipsaw pattern which describes the movement of stocks in a volatile market where the stock suddenly switches direction. - SPY Stock QQQ Stock Amazon Stock Tesla Stock TSLA and Bitcoin are in focus todayTrade With Justin httpsthealgo. 1 day agoAn analysis of the past four recessions by Bank of America Corp.

The SP 500 ended Fridays session up 3 while the Dow Jones Industrial Average tacked on 27. Yes Tesla is now cheap for a growth company. The metric that proves that is the price-to-sales ratio of 13.

In modern times during the. In bear traps there is a general expectation that the market is going to fall. The stock market is always right on price but it has a horrible sense of timing.

1 day agoThe current bear market in the SP 500 was officially called on June 13 2022. No bear markets in. It can also occur when a stock that looks poised to begin falling unexpectedly maintains an upward trend.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. Ad Our Suite of Platforms isnt Just Made For the Trading Obsessed - its Made by Them. They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic.

5 1931 and Nov. A bear trap is a colloquial trading term used to describe common situations in the market that seem to indicate an imminent downturn in a security but actually result in a steady or rising price price. STOCK MARKET BEAR OR BULL TRAP.

Its been a rough start to the year for investors and many. The Bear Traps report is a weekly independent Investment Research Publication focusing on global political and systemic risk with actionable trade ideas.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

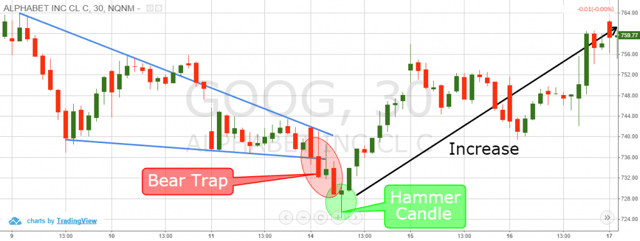

P F Bull Bear Traps Chartschool

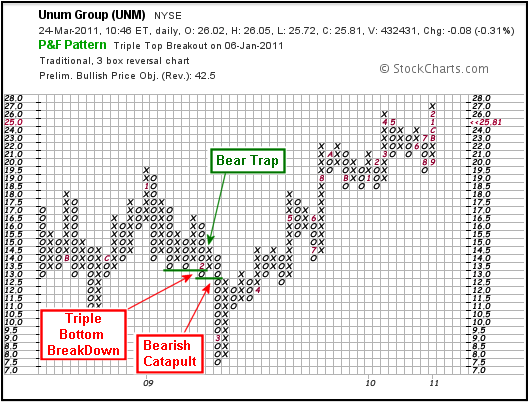

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Stock Trading Definition Example How It Works

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Explained For Beginners Warrior Trading

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)